Tampa Florida Industrial Real Estate Activity

At Bounat we work regularly to compile a comprehensive list of the most significant industrial commercial real estate activity, focusing heavily on construction projects and industrial real estate sales taking place each quarter in Tampa, Florida.

Tampa’s industrial market has experienced significant growth over the past few years, marked by brisk leasing activity, historic rates of net absorption, and strong rent growth. Its geographic advantages are apparent, as well. Sitting in the central part of Florida and along the waters of the Gulf of Mexico, Tampa makes for a great transportation hub of goods and materials coming in and out of the country for not only national, but international markets as well.

Below we go over several important statistics of industrial real estate in Tampa, FL.

Tampa Industrial Real Estate Stats and Updates Q4 2023

Industrial construction starts have slowed over the past year compared to previous years in the Tampa area after a big peak in 2021. Three years ago the market was fueled by comparatively strong demand and record low vacancies. More than 11 million square feet of industrial project starts have been recorded since the start of 2021, including over 5 million SF as of Q4 2023.

Industrial rents in Tampa remain on an upward trajectory, rising by over 14% over the last four quarters, as unwavering demand for distribution space fuels rent growth. The average industrial rent as of Q4 2023 is $12.21/SF (from $10.71/SF in 22Q4), up nearly 20% since the beginning of the pandemic and up roughly 30% over the past five years.

You can view our commercial properties in Florida to see what real estate assets are available for lease/sale.

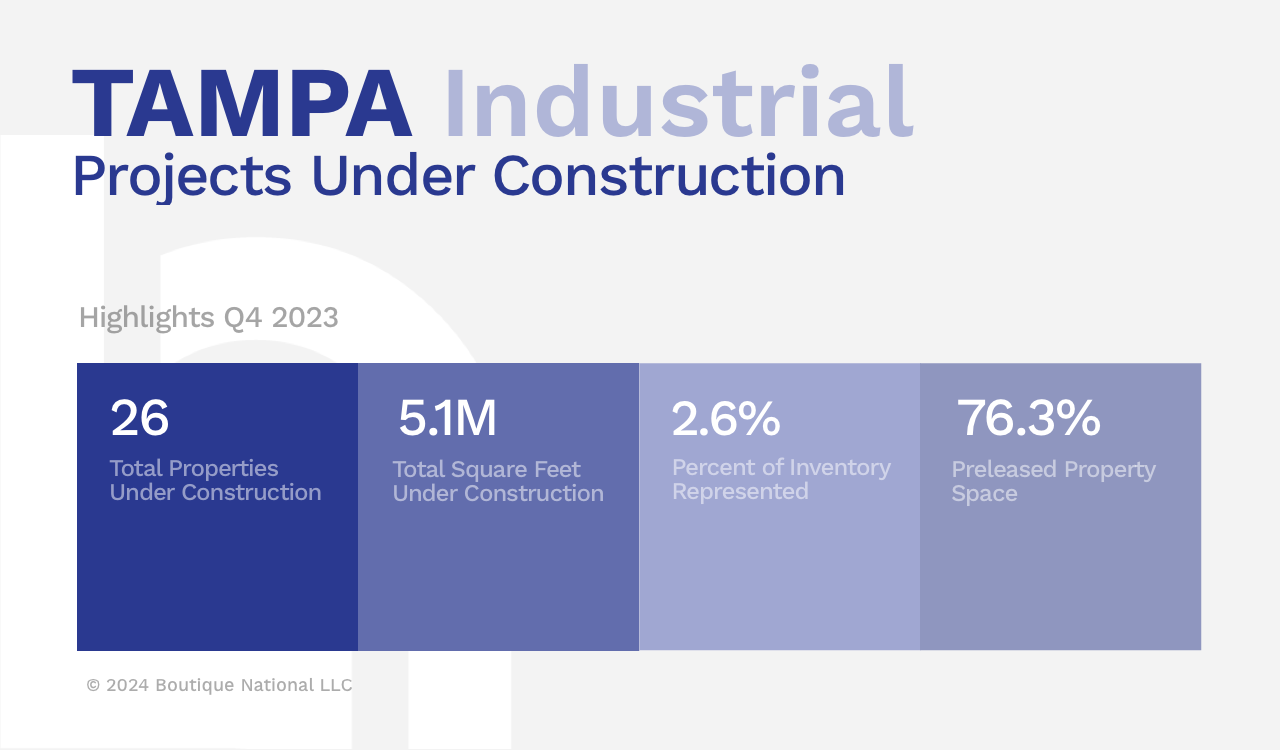

Tampa Industrial Projects Under Construction Stats in Q4 2023

Currently there are 26 industrial projects under construction in Tampa with a bit over 5 million square feet being added to the market. These projects represent 2.6% of the total inventory, and 76.3% of the space being constructed is already leased.

Total Properties Under Construction: 26

Total Square Feet Under Construction: 5.1M

Percent of Inventory Represented: 2.6%

Preleased Property Space: 76.3%

Top 10 Tampa Industrial Projects Under Construction in Q4 2023

1) Target – I-75 & Pasco Rd

Rating: 4*

Building SF: 1,383,296

Stories: 1

Start: March 2023

Complete: February 2024

Developer: NorthPoint Development

Owner: –

2) Coca-Cola Distribution – US 301 & Lee Roy Selmon

Rating: 4*

Building SF: 1,213,587

Stories: 1

Start: May 2023

Complete: February 2025

Developer: –

Owner: The Coca-Cola Company

3) North Pasco Corporate – 14640 Softwind Ln

Rating: 4*

Building SF: 500,000

Stories: 1

Start: February 2022

Complete: December 2023

Developer: Harrod Properties

Owner: Gary Connors

4) Feeding Tampa Bay – 4000 Causeway Blvd

Rating: 3*

Building SF: 215,000

Stories: 1

Start: March 2023

Complete: February 2024

Developer: Ryan Companies US, Inc

Owner: Feeding America Tampa Bay

5) Baytop Commerce Center – 13209 Memorial Hwy

Rating: 4*

Building SF: 172,620

Stories: 1

Start: June 2023

Complete: June 2024

Developer: Johnson Development Associates

Owner: Johnson Development Associates

6) Bldg H – 2795 Grand Ave

Rating: 3*

Building SF: 146,539

Stories: 1

Start: December 2022

Complete: September 2024

Developer: Greystar Construction & Development

Owner: Greystar Real Partners

7) Building 300 – 300 Tampa Commerce Blvd

Rating: 3*

Building SF: 124,000

Stories: 1

Start: March 2022

Complete: November 2023

Developer: Hines

Owner: Hines

8) Highpoint Commerce Center

Rating: 4*

Building SF: 122,160

Stories: 1

Start: May 2023

Complete: February 2024

Developer: Not Listed

Owner: Carroll Investment Properties

9) Mid-Pinellas Logistics Center

Rating: 4*

Building SF: 110,700

Stories: 1

Start: January 2023

Complete: February 2024

Developer: Johnson Development Associates

Owner: Not Listed

10) 3601 E 3rd

Rating: 4*

Building SF: 108,554

Stories: 1

Start: September 2023

Complete: March 2024

Developer: Mandich Group LLC

Owner: –

Tampa Industrial Real Estate Stats and Top 5 Industrial Property Sales Q4 2023

The total sales comparables that took place over the last 12 months is 403 industrial properties. The average cap rate for industrial real estate properties sold in Tampa is currently 6.8% with an average price / square foot of $141. Average vacancy at the time of these sales is 5.8%.

Sales Comparables: 403

Average Cap Rate: 6.8%

Average Price/ SF: $141

Average Vacancy at Sale: 5.8%

Tampa Industrial Real Estate Top Property Sales Q4 2023

1) Property: 6101 45th St N

*Rating: 4

Year Built: 2022

Building SF: 114,334

Vacancy: 0%

Price (PSF): $63,411,900 ($584)

Cap Rate: 4.8%

2) Property: 301 Logistics – 1220 N US Hwy 301

*Rating: 3

Year Built: 1972

Building SF: 390,711

Vacancy: 0%

Price (PSF): $46,000,000 ($118)

Cap Rate: Not Listed

3) Property: Tampa Airport Logisitics – 5416 Sligh

*Rating: 4

Year Built: 2022

Building SF: 185,298

Vacancy: 0%

Price (PSF): $36,374,404 ($196)

Cap Rate: Not Listed

4) Property: 8660 133rd Ave N

*Rating: 4

Year Built: 2023

Building SF: 160,000

Vacancy: 100%

Price (PSF): $29,600,000 ($185)

Cap Rate: Not Listed

5) Property: CAE USA – 4908 Tampa West Blvd

*Rating: 3

Year Built: 1979

Building SF: 214,806

Vacancy: 0%

Price (PSF): $22,950,000 ($107)

Cap Rate: 9.5%

*Rating is 1-5, 5 being the best

Take a look at our featured commercial real estate properties in Central Florida, or contact the Bounat team to start your own property search for commercial real estate space in the region.

* Data is courtesy of CoStar Group Inc.