Tampa Florida Industrial Real Estate Activity

At Bounat we work regularly to compile a comprehensive list of the most significant industrial commercial real estate activity, focusing heavily on construction projects and industrial real estate sales taking place each quarter in Tampa, Florida.

Tampa’s industrial market has experienced significant growth over the past few years, marked by brisk leasing activity, historic rates of net absorption, and strong rent growth. Its geographic advantages are apparent, as well. Sitting in the central part of Florida and along the waters of the Gulf of Mexico, Tampa makes for a great transportation hub of goods and materials coming in and out of the country for not only national, but international markets as well.

Below we go over several important statistics of industrial real estate in Tampa, FL.

Tampa Industrial Real Estate Stats and Updates Q1 2025

The Tampa Industrial market continues to outperform many major U.S. metros. However, the recent development wave, slowdown in large leases, and tenant move-outs from older buildings have pushed the vacancy rate to an eight-year high, impacting the magnitude at which owners can raise rents.

Tampa’s industrial vacancy rate has increased by 100 basis points from this time last year to 6.5%. This increase continues a three-year trend of supply outpacing demand, with vacancies rising from a record low of 3.6% in 2021.

Like many markets across the country, industrial absorption has been muted so far this year. While 2.0 million SF was absorbed over the trailing 12-month period, essentially all of that occurred in the later months of 2024. Absorption has been flat throughout 2025 as limited large move-ins have done little to offset move-outs by tenants from older buildings.

Tampa historically was not a big-box leasing market, with most leases under 50,000 SF. That changed starting in 2020 as the demand for large-scale distribution accelerated. Now, that sector of the market has cooled. Overall, five new leases for over 100,000 SF have been signed year to date, on par with 2024 figures but down from nine executed in both 2022 and 2023.

The lack of larger deals, especially in the form of build-to-suits, has dampened the market’s leasing activity and absorption over the past few years. Tampa went on an multi-year run of landing 1-million-SF+ BTSs with Target, Lowe’s, and City Furniture. Now the largest build- to-suit is a 400,000-SF facility for Baudocco Foods in Pasco County.

Developers are adjusting to the changing market conditions, with only 2.4 million SF currently under construction, a 60% decline from last year. Market participants have indicated that some of this slowdown is also due to the lack of land in the core Tampa submarkets of East Side and Westshore/Airport. In fact, industrial developers have been purchasing office complexes in these highly desirable industrial areas as traditional land positions are few and far between.

You can view our commercial properties in Florida to see what real estate assets are available for lease/sale.

Tampa Industrial Projects Under Construction Stats in Q2 2025

Tampa Industrial Projects Under Construction Stats in Q2 2025

Tampa’s construction pipeline is shifting back to historic norms as the number of build-to-suits fades. As the market enters 2025, less than 750,000 SF of the market’s 3.0 million SF currently under construction is being built to suit.

- Total Properties Under Construction: 19

- Total Square Feet Under Construction: 2.44M

- Percent of Inventory Represented: 1.2%

- Preleased Property Space: 22.6%

Top 10 Tampa Industrial Projects Under Construction in Q2 2025

1) Bauducco Foods – Chancey Rd

Rating: 4*

Building SF: 400,000

Stories: 1

Start: March 2025

Complete: July 2026

Developer: – Bauducco Foods, Inc

Owner: Bauducco Foods, Inc

2) Building B – 10860 Tradeway Blvd

Rating: 4*

Building SF: 202,430

Stories: 1

Start: Nov 2024

Complete: Nov 2025

Developer: Columnar Investments

Owner: Not Listed

3) Building 8 – 4132 Rice Rd

Rating: 4*

Building SF: 162,470

Stories: 1

Start: Nov 2024

Complete: Oct 2025

Developer: Not Listed

Owner: Central Florida Development

4) Building 3 West Side – 10407 Tanner Rd

Rating: 4*

Building SF: 156,495

Stories: 1

Start: August 2024

Complete: August 2025

Developer: Not Listed

Owner: EastGroup Properties, Inc.

5) Building C – 10698 Tradeway Blvd

Rating: 4*

Building SF: 155,661

Stories: 1

Start: Nov 2024

Complete: Aug 2025

Developer: Columnar Investments

Owner: Columnar Investments

6) South Tampa Trade Center – 4130 W Gandy Blvd

Rating: 4*

Building SF: 139,874

Stories: 1

Start: April 2025

Complete: Feb 2026

Developer: Miller Construction Company

Owner: LBA Realty

7) South Tampa Trade Center – 4130 W Gandy Blvd

Rating: 4*

Building SF: 139,864

Stories: 1

Start: April 2025

Complete: Feb 2025

Developer: Miller Construction Company

Owner: LBA Realty

8) Park 52 Logistics – 11600 Trade Park Way

Rating: 4*

Building SF: 130,148

Stories: 1

Start: August 2025

Complete: Aug 2026

Developer: McCraney Property Company

Owner: Morin Development Group

9) Airport Logistics Center – 4908 W Linebaugh Ave

Rating: 3*

Building SF: 125,400

Stories: 1

Start: July 2025

Complete: Dec 2025

Developer: Not Listed

Owner: Wrr of Marion County LLC

10) Tampa Logistics Center – 1751 Suddath Park St

Rating: 4*

Building SF: 125,052

Stories: 1

Start: Nov 2024

Complete: Oct 2025

Developer: Miller Construction Company

Owner: LBA Realty

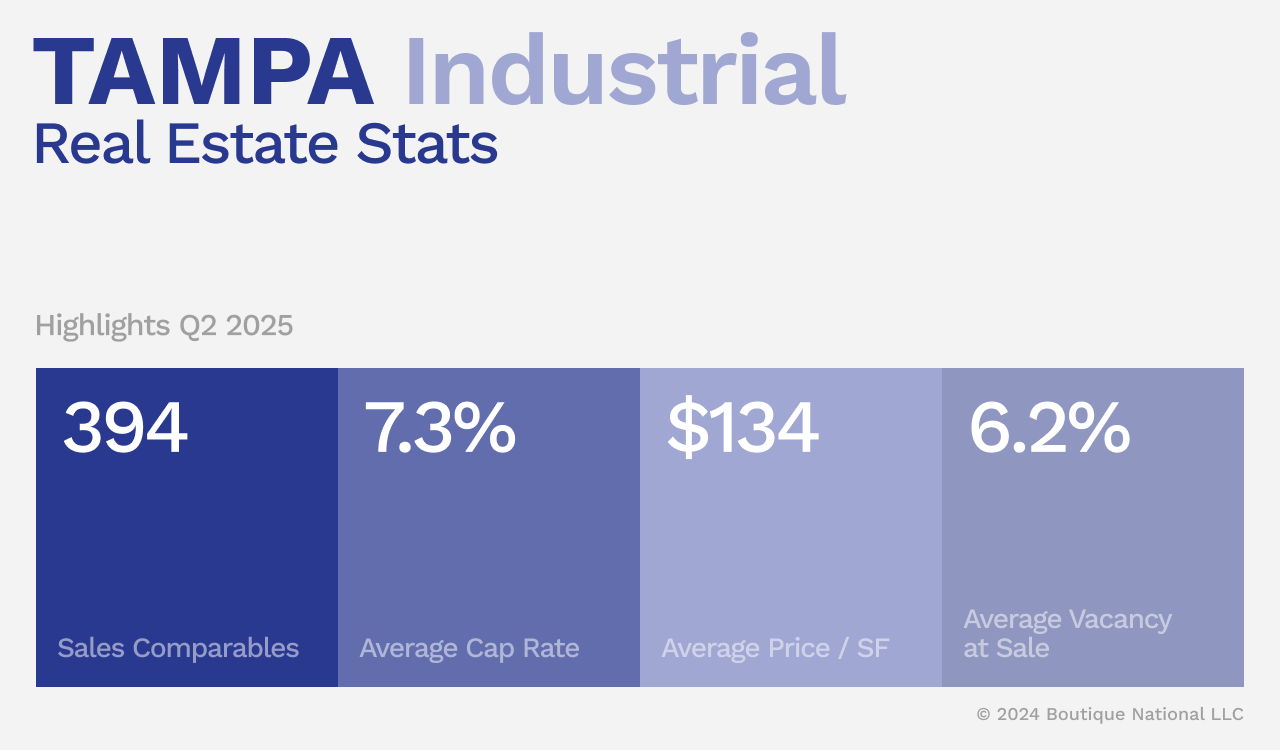

Tampa Industrial Real Estate Stats and Top 5 Industrial Property Sales Q2 2025

The Tampa industrial market has surpassed $150 million in quarterly sales volume for seven consecutive quarters. While current levels are well below what the market recorded in 2021 and 2022, it is far above pre-pandemic norms. The trailing 12-month sales volume is $880 million.

- Sales Comparables: 394

- Average Cap Rate: 7.3%

- Average Price/ SF: $134

- Average Vacancy at Sale: 6.2%

Tampa Industrial Real Estate Top Property Sales Past 12 Months

1) Peak Logistics Center I – 3501-3661 Fancy Farms Rd

Rating: 5*

Year Built: 2022

Building SF: 299,439

Vacancy: 0%

Price (PSF): $41,100,000 ($137)

Cap Rate: Not Listed

2) 10950 Belcher Rd S

Rating: 3*

Year Built: 1986

Building SF: 176,765

Vacancy: 0%

Price (PSF): $22,700,000 ($128)

Cap Rate: Not Listed

3) NVGTN Headquarters – 1990 Corporate Center Dr

Rating: 4*

Year Built: 2024

Building SF: 100,000

Vacancy: 0%

Price (PSF): $22,500,000 ($225)

Cap Rate: Not Listed

4) Crossroads Commerce – 10889 Crossroads Commerce

Rating: 4*

Year Built: 2017

Building SF: 113,729

Vacancy: 0%

Price (PSF): $22,100,000($194)

Cap Rate: Not Listed

5) 3401 Queen Palm Dr

Rating: 3*

Year Built: 2000

Building SF: 157,410

Vacancy: 0%

Price (PSF): $20,635,713 ($131)

Cap Rate: Not Listed

*Rating is 1-5, 5 being the best

Take a look at our featured commercial real estate properties in Central Florida, or contact the Bounat team to start your own property search for commercial real estate space in the region.

* Data is courtesy of CoStar Group Inc.