Tampa Florida Industrial Real Estate Activity

At Bounat we work regularly to compile a comprehensive list of the most significant industrial commercial real estate activity, focusing heavily on construction projects and industrial real estate sales taking place each quarter in Tampa, Florida.

Tampa’s industrial market has experienced significant growth over the past few years, marked by brisk leasing activity, historic rates of net absorption, and strong rent growth. Its geographic advantages are apparent, as well. Sitting in the central part of Florida and along the waters of the Gulf of Mexico, Tampa makes for a great transportation hub of goods and materials coming in and out of the country for not only national, but international markets as well.

Below we go over several important statistics of industrial real estate in Tampa, FL.

Tampa Industrial Real Estate Stats and Updates Q3 2024

Tampa’s industrial vacancy rate has reached its highest level in eight years, and the market recorded over one million square feet of negative absorption in the second quarter. These topline statistics are caused mainly by a few outlier tenant move-outs. Though the market does face some headwinds, the industrial fundamentals of the Tampa market are still strong.

The second quarter of 2024 was the first quarter this decade that the Tampa industrial market recorded significant negative absorption with roughly -1.2 million square feet. A few tenants make up the bulk of 2024 Q2’s move-outs, and the limited number of 100,000+ SF tenant move-ins exacerbated the issue. Coca-Cola, Wes-Flo, and Breakthru Beverage vacated over 740,000 SF combined in 2024 Q2. In contrast, PolyGlass USA was the only move-in larger than 100,000 SF, occupying 215,000 SF in I-4 Midway Logistics. Much of those move-outs were negated in the third quarter with Target’s completion and occupancy of its new 1.2 million SF warehouse in Pasco County. That, coupled with a few other move-ins, propelled the third quarter absorption rate to the third-best quarter in the past decade, with roughly 1.7 million SF.

Despite the rebound in the third quarter, Tampa’s industrial vacancy rate is up just over 100 basis points from this time last year to 5.6%. However, the rise in Tampa’s industrial vacancy rate is not a recent trend. Supply and demand have been out of balance since the end of 2021 and until the third quarter, vacancy had been increasing for six consecutive quarters.

You can view our commercial properties in Florida to see what real estate assets are available for lease/sale.

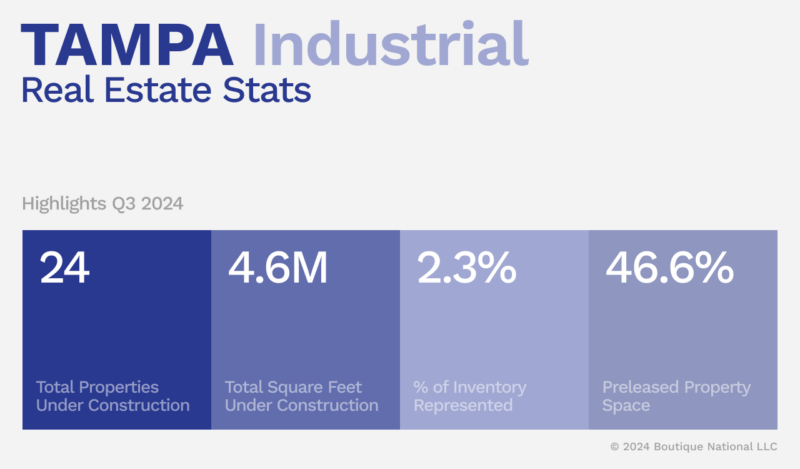

Tampa Industrial Projects Under Construction Stats in Q3 2024

Currently there are 24 industrial projects under construction in Tampa with a bit over 4.6 million square feet being added to the market. These projects represent 2.3% of the total inventory, and 46.6% of the space being constructed is already leased.

Top 10 Tampa Industrial Projects Under Construction in Q3 2024

1) Coca-Cola Distribution – US 301 & Lee Roy Selmon

Rating: 4*

Building SF: 1,213,587

Stories: 1

Start: May 2023

Complete:February 2025

Developer: –

Owner: The Coca-Cola Company

2) County Line Crossing – 3017 S County Line Rd

Rating: 4*

Building SF: 535,539

Stories: 1

Start: August 2024

Complete: April 2025

Developer: Robinson Weeks Partners

Owner: Robinson Weeks Partners

3) Building E2 – 475 Charlie Taylor Rd

Rating: 5*

Building SF: 517,000

Stories: 1

Start: March 2024

Complete: January 2025

Developer: The Sudler Companies

Owner: The Sudler Companies

4) Building 200 – 1540 N Frontage Rd

Rating: 4*

Building SF: 247,328

Stories: 1

Start: March 2024

Complete: January 2025

Developer: Clarion Partners

Owner: Clarion Partners

5) Building 100 – 1530 N Frontage Rd

Rating: 4*

Building SF: 218,780

Stories: 1

Start: March 2024

Complete: January 2025

Developer: Clarion Partners

Owner: Clarion Partners

6) Building B – 10860 Blvd

Rating: 4*

Building SF: 202,430

Stories: 1

Start: November 2024

Complete: July 2025

Developer: Columnar Investments

Owner: Not Listed

7) Building 8 – 4132. Rice Rd

Rating: 3*

Building SF: 162,470

Stories: 1

Start: November 2024

Complete: September 2025

Developer: Not Listed

Owner: Not Listed

8) Clearwater Logistics Center (13140 34th St N)

Rating: 4*

Building SF: 157,305

Stories: 1

Start: August 2024

Complete: March 2025

Developer: Not Listed

Owner: LBA Realty

8) Building C (10698 Ave)

Rating: 4*

Building SF: 155,661

Stories: 1

Start: November 2024

Complete: August 2025

Developer: Columnar Investments

Owner: Columnar Investments

10) Clearwater Logistics Center (13141 34th St N)

Rating: 4*

Building SF: 151,636

Stories: 1

Start: August 2024

Complete: March 2025

Developer: Not Listed

Owner: LBA Realty

Tampa Industrial Real Estate Stats and Top 5 Industrial Property Sales Q3 2024

The total sales comparables that took place over the last 12 months is 381 industrial properties. The average cap rate for industrial real estate properties sold in Tampa is currently 6.7% with an average price / square foot of $136. Average vacancy at the time of these sales is 7.0%.

Sales Comparables: 382

Average Cap Rate: 7.4%

Average Price/ SF: $131

Average Vacancy at Sale: 11.1%

Tampa Industrial Real Estate Top Property Sales Q1 2024

1) Property: 6708 Harney Rd

*Rating: 3

Year Built: 1987

Building SF: 434,034

Vacancy: 0%

Price (PSF): $49,200,000 ($113)

Cap Rate: Not Listed

2) Property: TIA Logistics Center – 6290 Hoover Blvd

*Rating: 5

Year Built: 2023

Building SF: 245,000

Vacancy: 0%

Price (PSF): $48,950,000 ($200)

Cap Rate: Not Listed

3) Property: Building 400 – 400 Tampa Commerce Blvd

*Rating: 4

Year Built: 2023

Building SF: 252,109

Vacancy: 0%

Price (PSF): $40,204,102 ($159)

Cap Rate: Not Listed

4) Property: Tampa Airport Logisitics – 5416 Sligh

*Rating: 4

Year Built: 2022

Building SF: 185,298

Vacancy: 0%

Price (PSF): $36,374,404 ($196)

Cap Rate: Not Listed

5) Property: Building 100 – 100 Tampa Commerce Blvd

*Rating: 4

Year Built: 2023

Building SF: 146,171

Vacancy: 0%

Price (PSF): $22,819,508 ($156)

Cap Rate: Not Listed

*Rating is 1-5, 5 being the best

Take a look at our featured commercial real estate properties in Central Florida, or contact the Bounat team to start your own property search for commercial real estate space in the region.

* Data is courtesy of CoStar Group Inc.