Florida Multifamily Commercial Real Estate Activity 2024

The imbalance between supply and demand is keeping Tampa’s multifamily rate around record levels. The Tampa market’s vacancy rate has surpassed 10% for the first time since 2009 and has increased by over 200 basis points year over year. The consistent influx of new supply has been more than the market can handle despite the market recording positive absorption for seven consecutive quarters.

Renter demand accelerated over the first six months of 2024, with roughly 3,700 units of absorption. Current levels are nearly a 25% increase from absorption recorded over the first half of 2023 and a 200% improvement over the latter half of that same year. At the same time, completions reached an all-time high, with 7,400 units delivered over the first six months of this year. The first quarter of 2024 was a record in terms of construction completions, with nearly 4,700 units. Pasco County, which has seen the lion’s share of new construction, has the highest vacancy rate in the region at roughly 20%. The submarket has absorbed approximately 1,900 units over the past year, while 4,600 units were delivered. In comparison, Northwest Tampa has the lowest vacancy rate at just 5%, in large part due to the lack of new construction over the past five years.

You can view our commercial properties in Tampa and elsewhere in the Florida market to see what’s available for lease and for sale at the moment.

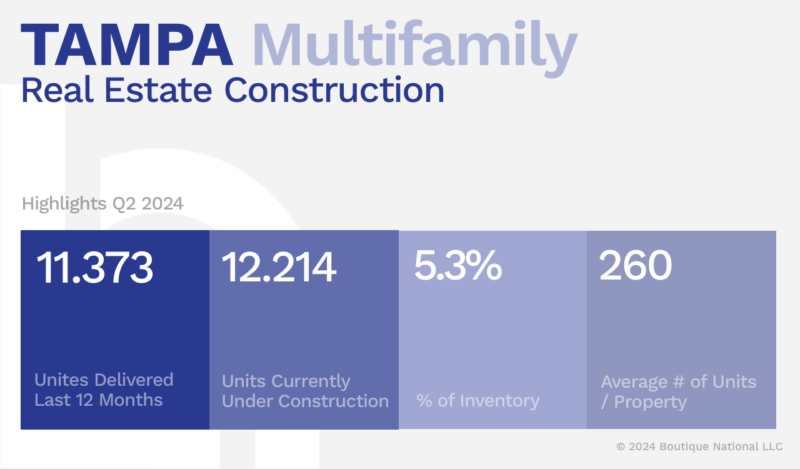

Tampa Multifamily Real Estate Construction Highlights Q2 2024

Unites Delivered Last 12 Months:11,373

Units Currently Under Construction:12,214

% of Inventory: 5.3%

Average # of Units / Property: 260

* Data is courtesy of CoStar Group Inc.

Tampa Multifamily Real Estate Under Construction in Q2 2024

1. Brandon Town Center – 507 S Lakewood Dr

Rating: 4*

Units: 660

Stories: 3

Start Date: March 2022

Completion Date: August 2024

Developer: Rotunda Land & Development LLC

Owner: Brandon Town Center Development

2. Vista Walk / St. Joe II

Rating: 3*

Units: 500

Stories: 1

Start Date: January 2024

Completion Date: December 2027

Developer: New Strategy Holdings, LLC

Owner: Not Listed

3. MAA Breakwater – 5440 W Tyson Ave

Rating: 4*

Units: 495

Stories: 5

Start Date: May 2023

Completion Date: Jan 2025

Developer: Mid-American Apartment Communities

Owner: Mid-American Apartment Communities

4. Arya – 375 St

Rating: 4*

Units: 415

Stories: 5

Start Date: April 2022

Completion Date: December 2025

Developer: Stock Development

Owner: Stock Development

5. Cobalt Apartments – 4434 Cobalt Brook Blvd

Rating: 5*

Units: 401

Stories: 4

Start Date: August 2022

Completion Date: September 2024

Developer: Flournoy Companies

Owner: Flournoy Companies

6.Marina Club – 4311 34th St S

Rating: 3*

Units: 400

Stories: 8

Start Date: October 2022

Completion Date: December 2024

Developer: Skanska USA Building, Inc

Owner: Marina Walk, LLC

7. Linz Bayview – 2975 Gulf To Bay Blvd

Rating: 4*

Units: 398

Stories: 5

Start Date: April 2022

Completion Date: April 2024

Developer: Davis Development

Owner: Davis Development

8. La Union – 1720 Nick Nuccio Pky

Rating: 4*

Units: 390

Stories: 7

Start Date: April 2024

Completion Date: September 2024

Developer: Kettler

Owner: Kettler

9.Siena Cove – 6243 Old Pasco Rd

Rating: 3*

Units: 375

Stories: 2

Start Date: June 2022

Completion Date: December 2024

Developer: –

Owner: AMH

10. 2302 E Hillsborough Ave

Rating: 3*

Units: 354

Stories: 3

Start Date: June 2024

Completion Date: December 2024

Developer: –

Owner: The Richman Group of Florida, Inc.

Tampa Multifamily Sales Activity in Q2 2024

Roughly 12,000 units are under construction, down from 17,000 units this time last year. As multifamily fundamentals have soured, coupled with increased difficulty in securing funding, fewer new developments have broken ground through the first half of the year. Roughly 3,500 units started construction, down from nearly 5,000 over the same period in 2023.

Tampa has now recorded asking rent decline for four consecutive quarters. Asking rents are down -1.3% from this time last year as landlords have contended with increased competition for renters as thousands of units have come online. Pasco County has one of the largest supply and demand gaps in Tampa and, in turn, has recorded one of the steepest declines in rents, down 3% from this time last year.

Tampa’s multifamily market is facing significant supply headwinds that will have a cascading impact on rents and vacancies. 2024 is on pace to be a record year for construction completions, with roughly 11,000 units. Tampa’s vacancy rate is expected to remain well above the five-year vacancy rate average of 6.9% over the next several years. A prolonged period of elevated vacancy will likely make it difficult for landlords to push rates, even at pre-pandemic levels. Rent growth should return to positive territory by 2025 but to half the ten-

year average annual growth rate of 5.0%.

You can view our commercial properties, including multifamily assets in Tampa and elsewhere in Central Florida to see what’s available for lease and for sale at the moment.

Key Tampa Multifamily Real Estate Sales Statistics Q1 2024

Sales Comparables: 108 Assets

Average Price / Unit: $197,000

Average Price / Sale: $18,300,000

Average Vacancy During Sale: 9.2%

Significant Multifamily Sales in Tampa Q1 2024

1) Bell Lansbrook Village – 3751 Pine Ridge Blvd

Rating: 4*

Year Built: 2004

Units: 774

Vacancy: 10.0%

Sale Date: 7/10/23

Price: $201,000,000

Price/Unit: $259,689

Price/SF: $259

2) Rowan Pointe – 7950 Park Blvd

Rating: 4*

Year Built: 2022

Units: 349

Vacancy: 14.0%

Sale Date: 9/12/23

Price: $108,600,000

Price/Unit: $311,174

Price/SF: $350

3) Azora at Cypress Ranch – 17583 Bellavista Loop

Rating: 4*

Year Built: 2022

Units: 331

Vacancy: 7.9%

Sale Date: 8/30/23

Price: $96,000,000

Price/Unit: $290,030

Price/SF: $154

4) Avasa Grove West Apartments – 27791 Dream Falls Dr

Rating: 4*

Year Built: 2022

Units: 330

Vacancy: 14.9%

Sale Date: 9/22/23

Price: $95,000,000

Price/Unit: $287,878

Price/SF: $272

5) Seven Lakes at Carrollwood – 3303 – 3401 N Lakeview Dr

Rating: 3*

Year Built: 1983

Units: 640

Vacancy: 10.9%

Sale Date: 10/10/2023

Price: $94,364,000

Price/Unit: $147,443

Price/SF: $208

6) Boot Ranch Apartments – 1350 Seagate Dr

Rating: 4*

Year Built: 1996

Units: 432

Vacancy: 1.9%

Sale Date: 10/19/2023

Price: $89,619,000

Price/Unit: $207,451

Price/SF: $214

7) Azalea Apartments – 2633 Azalea Garden Pl

Rating: 4*

Year Built: 2022

Units: 292

Vacancy: 10.6%

Sale Date: 8/14/2023

Price: $85,750,000

Price/Unit: $295,000

Price/SF: $260

8) Tessa Springs – 11810 Uptown Walker Pl

Rating: 4*

Year Built: 2022

Units: 292

Vacancy: 10.6%

Sale Date: 8/14/2023

Price: $83,750,000

Price/Unit: $286,815

Price/SF: $217

9) Pearce at Pavilion

Rating: 4*

Year Built: 2016

Units: 250

Vacancy: 10.0%

Sale Date: 12/28/2023

Price: $66,000,000

Price/Unit: $264,000

Price/SF: $184

10) Sole at Citrus Park – 6201 Gunn Hwy

Rating: 4*

Year Built: 1999

Units: 264

Vacancy: 7.6%

Sale Date: 10/27/2023

Price: $58,000,000

Price/Unit: $219,696

Price/SF: $184

Take a look at our featured Tampa multifamily properties for sale, as well as a variety of other Tampa commercial real estate properties that are currently available. You can also contact the Bounat team to start your own Central Florida property search.

* Data is courtesy of CoStar Group Inc.