Tampa Office Real Estate Activity Highlights: Q3 2025

The Tampa office market has exhibited a distinct divergence across asset classes over the past few years. Demand for 4 & 5 Star properties remains robust, with these top-tier buildings capturing most of the market’s leasing activity and positive absorption. In contrast, mid-and lower-tier properties, classified as 1 & 2 Star and 3 Star, continue to see net tenant losses, driving negative trends in overall market performance.

Over the past year, Tampa has recorded -370,000 SF of absorption, in large part due to the performance of low- to mid-tier properties. Conversely, 4 & 5 Star assets posted 400,000 SF of absorption during the same period.

Over the first three quarters of the year, leasing activity totaled 5.7 million SF, with just under half comprised of transactions in 4 & 5 Star properties. Fisher Investments, Footlocker, Holland & Knight, and American Integrity Insurance committed to 600,000 SF of new space in 4 & 5 Star buildings in 25Q1. GEICO also leased 190,000 SF in three 3 Star buildings in Westshore. Midtown East also secured roughly 50,000 SF in leasing activity with TeamViewer and a major accounting consulting firm, both leasing a full floor in the third quarter.

While some tenants are relocating from existing spaces, these transactions are expected to generate continued positive absorption in the high-end cohort over the coming quarters. Enhanced leasing momentum in 4 & 5 Star properties has been seen throughout the Tampa region, even in secondary suburban submarkets such as Gateway, Northwest Tampa, and East Tampa.

Market participants have indicated that the overall sentiment for Tampa’s office market has improved considerably because of these leases, in large part due to them taking some large blocks of second-generation, suburban office vacancies off the market.

Market vacancy rates have increased modestly over the past year, now standing at 9.9%. This uptick is due to the negative absorption seen so far this year, coupled with the delivery of Midtown East in April. At 430,000 SF, it is the largest new office building to be delivered in Tampa since Thousand & One Water Street in 2021. Midtown East, owned by Highwoods, currently only has 25,000 SF available for lease.

Annual rent growth stands at 2.9%, outpacing the national average of 0.7% but remaining below pre-pandemic norms of 5-6%. This moderation is primarily due to limited leasing velocity in low and mid-tier properties. Many of which have large blocks of space that have been on the market for several years, with landlords more apt to drop rates than push them. The divergence in performance based on asset class is likely to continue. Poor performance in low- to mid-tier properties could weigh on overall fundamentals over the near term. As more desirable, high-quality space is leased, the positive momentum seen there will be unlikely to offset the tenant losses and rent growth stagnation seen in low- to mid-tier office properties.

You can view our commercial properties in Tampa and elsewhere in Central Florida to see what real estate assets are available for lease / sale.

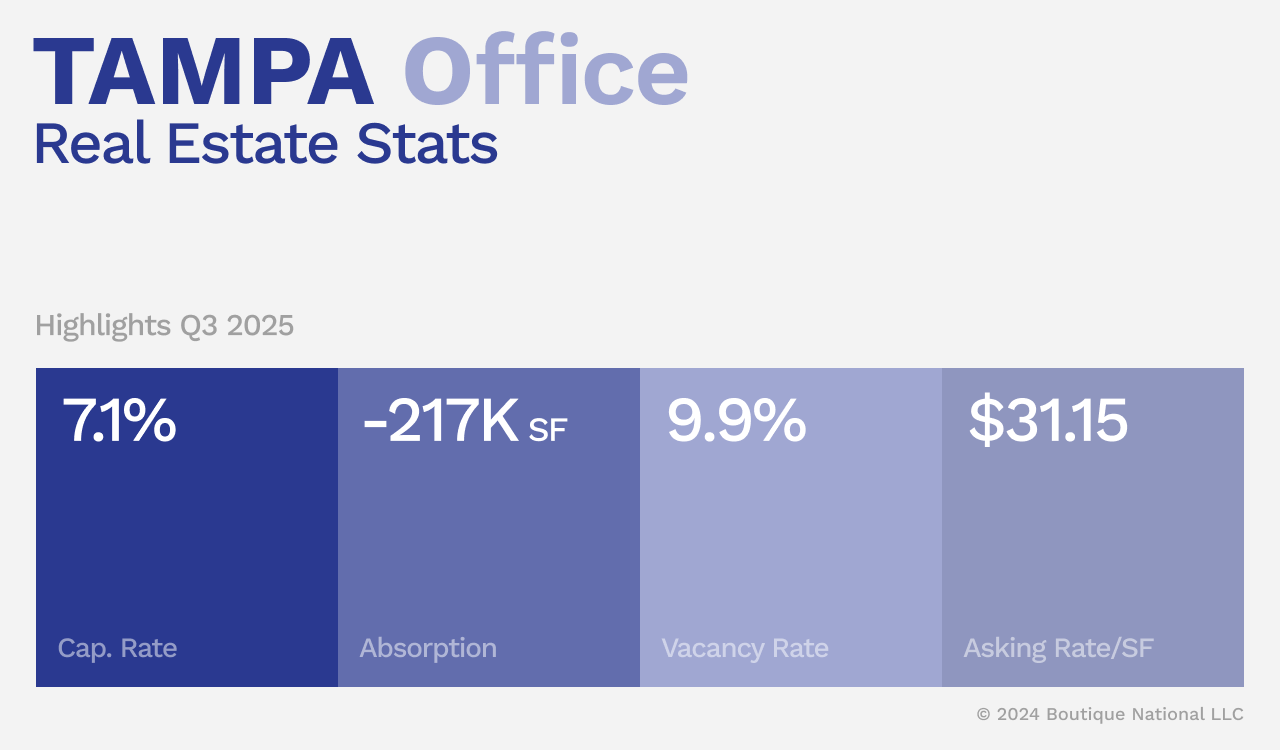

Tampa Office Real Estate Stats Highlights Q3 2025

Below are some key statistics for the office market in Tampa over the last quarter: cap rate, absorption, vacancy rate, and the current asking rate per square foot.

- Cap Rate: 7.1%

- Absorption: -216,998 SF

- Vacancy Rate: 9.9%

- Asking Rate / SF: $31.15

Tampa Office Real Estate Stats Overview – Last 12 Months

Over the last 12 months, the total deliveries of completed Tampa office real estate space is 610K square feet, while there has been an aggregated absorption of (367K) square feet. The current vacancy rate of office space in the area is 9.9%, and the rental rate has grown 2.9% total during the same time. To give some context, Tampa’s office vacancy rate is below the historical average of 9.8%.

- 12 Month Deliveries (in SF): 625,000

- 12 Month Absorption (in SF): (367,000)

- Vacancy Rate: 9.9%

- 12 Month Rent Growth: 2.9%

Tampa Office Real Estate Sales Summary for Q3 2025

Office sales activity remained below pre-pandemic norms in 2024, with the Tampa market recording just $800 million in total sales volume. By comparison, current investment volumes are well below the five-year average of $1.0 billion. Pricing has mostly plateaued over the past year around $184, and very few trades have been cap-rate-driven in the Tampa market. The vast majority of sales have been smaller owner-user transactions, with only a dozen trades for over $10 million in 2024.

Tampa Florida Significant Office Property Sales for Q3 2025

Office sales activity remains below pre-pandemic norms in Tampa, with the market recording just $1.0 billion million in total sales volume over the past year. By comparison, current investment volumes are well below the 2015 to 2019 annual average of $1.2 billion. Further, the trend of one or two trades driving quarterly activity has carried over into this year.

Hospital groups continue to be actively purchasing traditional and medical office buildings in the region as they look to capture market share.

BayCare Health Systems purchased three buildings in Tampa Bay Park, totaling 615,000 SF, from Highwoods Properties in February 2025 for $145 million, $235/SF. That one transaction accounted for over 50% of total sales volume in 2025Q1. BayCare’s main hospital campus, St. Joseph’s Hospital, is located just next door, and the operator has long eyed these office buildings as an expansion opportunity. One of Tampa’s largest healthcare systems plans to move some administrative offices to its new campus as well as expand its patient care and medical education programs.

Tampa General Hospital acquired 17 Davis Boulevard from Healthcare Realty in September for $22 million, or $187/SF. USFHealth, with whom Tampa General has a partnership, recently opened an acute care clinic and is one of the largest tenants in the building. In addition, AdventHealth purchased the University Professional Center, a 101,000-SF multi-tenant medical office building less than a mile from the AdventHealth Tampa Hospital. The 1970s vintage building was recently renovated and traded at a 9.3% cap rate.

The trend of industrial or multifamily developers purchasing office buildings is picking up steam in the Tampa market. In East Tampa, an East Group purchased a 66-acre corporate campus previously occupied by Progressive Insurance for $32 million, or roughly $485,000/acre. The three-building campus will be knocked down to make way for a multi-building 550,000-SF industrial park. In Downtown Tampa, Stock Development purchased 601 N Ashley Drive for $40 million. The transaction included the plans and approvals for the redevelopment of the site for up to 960,000 SF in a 43-story apartment tower with 480 units and 916 parking spaces.

Pricing has mostly plateaued here at around $185/SF, and very few office transactions are cap-rate driven. Market participants have indicated that there is limited investment demand for traditional office product. While there may be a few larger transactions, this market is more apt to see industrial or multifamily developers buying office buildings to redevelop than widespread office investment over the coming quarters.

- Sales Comparables: 588

- Average Cap Rate: 7.0%

- Average Price / SF: $187

- Average Vacancy During Sale: 9.6%

Here are the Top 5 Tampa Office Property sales during the last 12 months:

1) LakePointe 2 – 3111 W Dr Martin Luther King Jr Blvd

Rating: 4*

Building SF: 223,644

Year Built: 2000

Vacancy: 24.9%

Sale Date:2/3/2025

Price: – $59,424,908

Price/SF: $266

Rating: 4*

Building SF: 95,896

Year Built: 2012

Vacancy: 33.0%

Sale Date: 12/27/2024

Price: $37,500,000

Price/SF: 391

Office Space Under Construction in Tampa Q3 2025

Here are the top stats for office properties currently under construction in Tampa, FL. From the 20 properties under construction, there is a total of 479,530 square feet being added to the market, which represents 0.4% of the total market. 70.6% of the under-construction space is preleased.

- Total Properties Under Construction: 20

- Total Square Feet Being Built: 479,530

- % of Inventory Under Construction: 0.4%

- Preleased: 70.6%

Here are the top office real estate assets under construction in the Tampa market.

1) Orlando Health Medical.. – 501 7th St S

Rating: 4*

Building SF: 120,000

Stories: 4

Start: Oct 2023

Complete: – Dec 2025

Developer/Owner: Not Listed / Orlando Health

Rating: 4*

Building SF: 60,880

Stories: 3

Start: Nov 2024

Complete: Dec 2025

Developer/Owner: Optimal Outcomes LLC

Rating: 3*

Building SF: 60,000

Stories: 3

Start: Oct 2023

Complete: – Dec 2025

Developer/Owner: Not Listed / Orlando Health

5) Building 1 – 00 Wiregrass Ranch Blvd

Rating: 4*

Building SF: 46,000

Stories: 2

Start: Oct 2025

Complete: Jul 2026

Developer/Owner: Not Listed / Flagship Healthcare Properties

Take a look at our featured Tampa office real estate spaces, or other Tampa commercial real estate properties here, or contact the Bounat team to start your own search for properties in the area.

* Data is courtesy of CoStar Group Inc.