The commercial real estate brokers at Bounat work diligently to compile a comprehensive list of the top commercial real estate activity in the Florida region on a frequent basis.

Tampa’s retail availability has hovered around all-time lows for the past two years, but national-level bankruptcies and store closures are bringing new spaces to the market in 2025. Population growth and an expanding consumer base have fueled Tampa’s retail demand over the past several years. Prior to 2021, Tampa’s retail availability hadn’t been below 5% since 2007. As the population has increased by 230,000 people over the past five years, retail demand has been near all-time highs. Availability has been around 3.5% since 2022, and market participants believe that availability in well-maintained centers in prime locations boasts a collective availability closer to 1%. However, availability has ticked higher over the past few months and is expected to continue to do so over the near term.

New spaces are coming to the market as national brands have filed or are expected to file for bankruptcy and close stores. Retailers like Macy’s, Big Lots, Conn’s, and Party City have and will put hundreds of thousands of square feet of retail space on the market. While that will increase the region’s availability rate, some believe these new availabilities will create opportunities for landlords and prospective tenants. On the landlord’s side, many of these bankruptcies provide the opportunity to increase the quality of the tenant base as well as bring rents up to market.

Tampa has been a leader in the US for retail rent growth, increasing nearly 35% over the past five years to a market average of $26.00/SF on a triple net basis. For tenants, retail space on desirable corridors has been difficult to find over the past several years. Many of Tampa’s largest leases over the past year have been for build-to-suits. New spaces could provide opportunities for prospective tenants to lease and enter or expand into the market more quickly. The current pipeline will do little to alleviate demand as only 410,000 SF is under construction. Land and construction costs coupled with a prolonged entitlement timeline have made new development difficult to pencil in the Tampa region.

While new ground-up retail development is rare, there are several redevelopments in the early stages, with retail components expected to break ground in the coming years. Westshore Plaza, which encompasses roughly 54 acres at the corner of Kennedy Boulevard and Westshore Boulevard, is for sale after receiving entitlements for redevelopment, including over 900,000 SF of new retail.

Tampa’s retail market is likely to continue to see availability rates around the record-low levels it has seen over the past few years. There is essentially no new construction happening that would put upward pressure on the market’s availability. In addition, while new spaces have and are expected to continue to come to the market, many will likely be leased up quickly.

You can view our commercial properties in Florida to see what real estate assets are available for lease/sale.

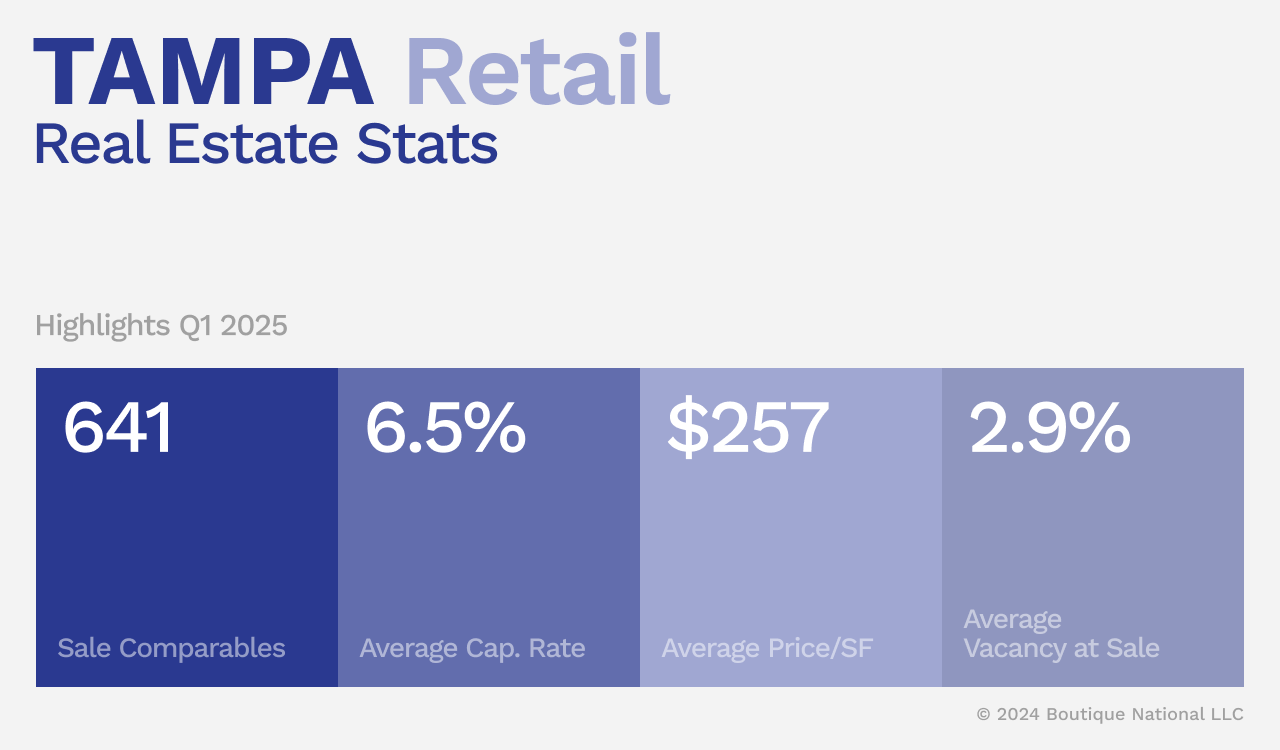

Tampa Retail Real Estate Statistic Highlights Q1 2025*

12 Mo Deliveries in SF: 1.2M

12 Mo Net Absorption in SF: 603K

Vacancy Rate: 3.3%

Market Asking Rent Growth: 3.3%

Tampa Retail Real Estate Sales Statistics Q1 2025*

Sale Comparables: 641

Average Cap Rate: 6.5%

Average Price / SF: $257

Average Vacancy at Sale: 2.9%

Significant Retail Commercial Real Estate Sales Tampa Q1 2025*

Below are the top retail real estate sales inked in Tampa during the last 12 months.

1) Nature Coast Commons (1253 – 1437 Wendy Ct)

Rating: 4*

Year Built: 2009

Building SF: 225,806

Vacancy: 0.8%

Sale Date: 8/30/2024

Price: $40,000,000

Price/SF: $177

2) 1508 W Brandon Blvd

Rating: 3*

Year Built: 2003

Building SF: 64,773

Vacancy: 0%

Sale Date: 9/30/2024

Price: $37,200,000

Price/SF: $574

3) The Walk at Highwoods… (18001-18045 Highwoods…)

Rating: 4*

Year Built: 2001

Building SF: 111,000

Vacancy: 0%

Sale Date: 7/3/2024

Price: $24,007,569

Price/SF: $216

4) 2495 Gulf To Bay Blvd

Rating: 3*

Year Built: 1995

Building SF: 114,225

Vacancy: 0%

Sale Date: 6/4/2024

Price: $23,000,000

Price/SF: $201

Cap Rate: 5.2%

5) Crosswinds Shopping Center (2020-2060 66th St N)

Rating: 3*

Year Built: 1971

Building SF: 143,899

Vacancy: 0%

Sale Date: 11/7/2024

Price: $20,500,000

Price/SF: $142

6) Village Market at Wesley… (5325-5429 Village Market)

Rating: 3*

Year Built: 1988

Building SF: 72,121

Vacancy: 0%

Sale Date: 12/19/2024

Price: $19,503,563

Price/SF: $270

Cap Rate: –

7) Granada Plaza (1491-1575 Main St)

Rating: 3*

Year Built: 1983

Building SF: 74,200

Vacancy: 9.6%

Sale Date: 12/17/2024

Price: $16,750,000

Price/SF: $226

8) 1502-1512 E 7th Ave

Rating: 4*

Year Built: 1900

Building SF: 28,000

Vacancy: 0%

Sale Date: 1/23/2025

Price: $15,000,000

Price/SF: $536

9) 2317 Gunn Hwy

Rating: – 3*

Year Built: 2024

Building SF: 138,339

Vacancy: 0%

Sale Date: 11/20/2024

Price: $14,340,344

Price/SF: $104

Cap Rate: 5.2%

10) Rivian (701 N Dale Mabry Hwy)

Rating: – 3*

Year Built: 1992

Building SF: 25,000

Vacancy: 0%

Sale Date: 4/11/2025

Price: $13,500,000

Price/SF: $540

Cap Rate: 6.8%

Significant Retail Commercial Real Estate Leases Tampa Q1 2025*

Below are the top retail real estate leases signed in Tampa during the last 12 months.

1) 5591 N US Highway 41

Leased SF: 167.219

Quarter: Q1 25

Tenant: Walmart

Tenant Rep: Not Listed

Leasing Rep: Not Listed

2) City Furniture – Pasco County

Leased SF: 144,372

Quarter: Q2 24

Tenant: City Furniture

Tenant Rep: Not Listed

Leasing Rep: Colliers

3) Coastal Way – Hernando County

Leased SF: 103,500

Quarter: Q2 24

Tenant: BJ’s Wholesale Club

Tenant Rep: LQ Commercial Rea…

Leasing Rep: Brixnor Property Group

4) 16400 State Road 54

Leased SF: 70,305

Quarter: Q1 25

Tenant: The Chapel Church

Tenant Rep: Not Listed

Leasing Rep: ONEIL Commercial Ad…

5) The Factory St. Pete – South Pinellas

Leased SF: 51,000

Quarter: Q2 2024

Tenant: St. Pete Athletic Paddle a…

Tenant Rep: Axxos:KW Commercial

Leasing Rep: Axxos

Significant Retail Commercial Real Estate Construction Projects Tampa Q1 2025

Properties Under Construction: 25

Total Square Feet Under Construction: 406,675

Percentage of Inventory: 0.2%

Preleased: 83.8%

1) 5591 N US Highway 41

Rating: 4*

Start: January 2025

Completion: May 2026

Building SF: 170,995

Developer / Owner: Walmart

2) 26946 Halter Loop

Rating: 3*

Start: June 2024

Completion: June 2025

Building SF: 40,000

Developer / Owner: Bissett McGrath Properties

3) Shoppes at Alafia Upper Alafia Ct

Rating: 5*

Start: January 2025

Completion: September 2025

Building SF: 32,115

Developer / Owner: –

4) Gasworx E2 1301 E 4th Ave

Rating: 4*

Start: March 2025

Completion: April 2026

Building SF: 30,000

Developer / Owner: Darryl Shaw / Darryl Shaw

5) 8224 Little Rd

Rating: 3*

Start: March 2025

Completion: September 2025

Building SF: 19,400

Developer / Owner: Tricor International Corporation / Pantropic Design

Take a look at our featured Tampa office real estate spaces, or other Tampa commercial real estate properties here, or contact the Bounat team to start your own search for properties in the area.

* Data is courtesy of CoStar Group Inc.